I remember the exact moment when it hit me.

I was standing in line at the grocery store with a basket full of stuff I needed — not even luxury stuff, just bread, some eggs, rice, a few vegetables — and my card got declined. Not because it was broken. Not because of a bank issue.

It got declined because I had nothing left.

I smiled awkwardly at the cashier, pulled out my phone to “check something,” and quietly walked away like I’d forgotten my wallet at home. But the truth? I had just blown through my last €50 two days earlier without even realizing it.

That moment hit different.

It wasn’t about the embarrassment. It was about the feeling of being completely out of control. I was working, I wasn’t being reckless, but I clearly had no clue where my money was going. And that scared me.

That night, I went home and opened a blank page in my notebook. I didn’t Google “how to fix my finances” or look for fancy budget templates. I just started writing down what I remembered spending money on that week.

It was messy — food delivery, a cheap hoodie I saw on sale, a bunch of little transactions that didn’t seem like a big deal in the moment. But together? They drained my entire paycheck.

That was the first step: facing the truth.

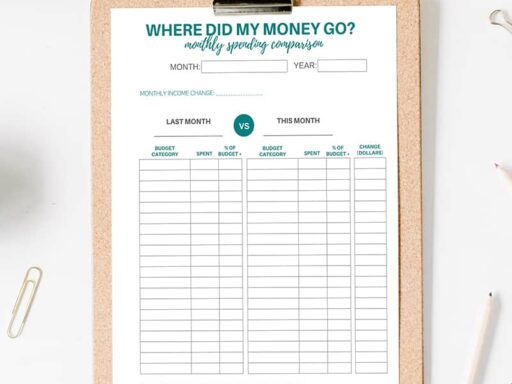

Over the next few weeks, I kept writing everything down. No budget yet. No goals. Just writing what I spent. That alone made me slow down — because spending became visible. And when you see where your money goes, you stop being surprised by your empty balance.

Eventually, I started grouping expenses into rough categories. Bills, food, fun, random stuff. And that’s when I noticed something weird — I was spending more on “random stuff” than on food. It was little things: €5 here, €10 there, things that added no real value to my life.

That’s when I decided to try budgeting. But not the strict, color-coded type. Just limits. I gave myself a weekly amount for food and fun. I didn’t always stick to it — but even trying gave me more control than I’d ever had.

Saving came next. I started small — like €5 small. At first, it felt pointless. But after a couple months, I had €60 sitting in a separate account. It wasn’t a fortune, but it was something. It was proof that I could save, even with the same income.

Over time, I made other changes:

-

I canceled subscriptions I never used

-

I started cooking more at home

-

I created a “do not touch” savings account

-

I even sold a few old things online for quick cash

And no — my life didn’t suddenly become perfect. I still mess up. I still forget to track sometimes. But I never forgot that moment at the grocery store. That one experience gave me the push I needed.

I’m not sharing this as advice from an expert. I’m sharing it because I know how it feels to have a job, to work hard, and still feel broke. And I also know that you don’t need to be perfect to start changing your money habits.

If you’re reading this and you feel out of control — that’s okay. You don’t have to fix everything tonight. Just start with one thing. Maybe track your spending for a few days. Or move €10 to savings. Or unsubscribe from one thing you don’t use.

It’s not about being perfect. It’s about being a little more intentional than you were yesterday.

And trust me — that adds up.